Our Business

The services and insurance coverages we provide protect our clients, allow them to rebuild after major losses and improve their resilience. Helping our clients manage uncertainty begins with assessing and addressing risks and collaborating in a changing world that includes heightened climate perils and evolving societal demands.

Enterprise Risk Management Strategy

Our Enterprise Risk Management (ERM) team formally identifies and integrates sustainability performance, including climate change and climate-related risks, into our Risk Register and extends that analysis to specific climate-related business risk evaluations in line with the recommendations of the Taskforce for Climate-related Financial Disclosures (TCFD). We review these evaluations and validate the underlying data at least annually. See our TCFD Report (page 6).

- Risk management responsibilities are delegated across our organization through a “Three Lines of Defense” approach to risk governance. See the detailed table below.

- Our Board of Directors (Board) is responsible for governing the organization, overseeing its operations and assessing the performance of executive management in implementing corporate strategies. See the structure of our Board’s oversight of key risks through the respective committees on page 13 of our Sustainability Report.

- Specific areas of research and focus in 2024 included Australian models, European severe thunderstorm, Canadian and U.S. Wildfire, Canadian severe convective storm and Caribbean Earthquake and Hurricane.

Evaluating Environmental Exposures

The insurance industry is positioned to play a role in supporting low carbon technologies. We are taking steps to address climate challenges and support our insureds in their efforts to adapt and strengthen their resilience.

Our Approach

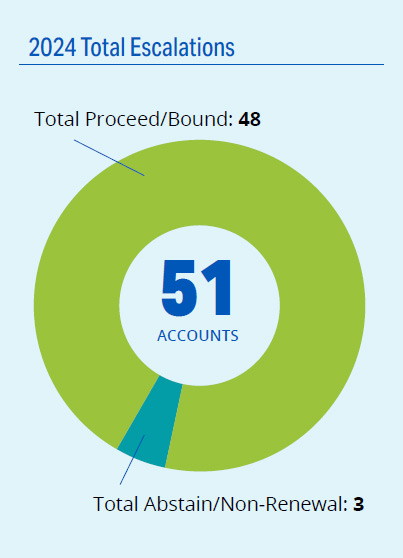

As a global insurer, we take a proactive approach to reducing risk and taking advantage of opportunities in our underwriting for the benefit of our stakeholders. Through our Thermal Coal Policy, we integrate environmental considerations into our underwriting processes for thermal coal-related business accounts. This policy, which applies to our global insurance underwriting, outlines key considerations designed to fully evaluate risk and trigger escalations, as necessary, for further review. Our U.K. insurance companies also apply sector-specific guidelines pertaining to Arctic energy exploration and production and oil sands mining and surface extraction. These policies set forth the scope and screening parameters for the assessment and escalation referral process for business accounts in these environmentally sensitive sectors. The chart shows the outcome of our 2024 submissions in these areas.

2024 Submissions

Since the implementation of our Thermal Coal Policy, our underwriters are declining such business accounts for various reasons including, but not limited to:

- Account had no climate-related transition plan.

- Insured was benefiting from deforestation.

- Insured was a stand-alone coal mine.

This chart represents our 2024 worldwide escalations, including global coal escalations and 10 referrals from our U.K. business related to oil sands and Arctic energy exploration and drilling (all proceeded/bound).

Providing Environmentally Sustainable Insurance Solutions

We are taking steps to address climate challenges and support our insureds through our specialty insurance products and solutions:

- Our dedicated team of surety underwriters specializes in the renewable energy industry, with a focus on solar, wind, battery/energy storage, biomass and hydro opportunities for financial assurance requirements.

- We offer coverage solutions for sustainable energy companies. Our products encompass wind and solar power generation (both offshore and onshore); battery energy storage systems (BESS); ethanol, hydrogen, and other biofuels including sustainable aviation fuel (SAF); carbon capture and storage (CCS); nuclear, hydro, and geothermal power generation; direct air capture and other innovative technologies.

- We are committed to identifying business opportunities associated with environmentally friendly practices that also incentivize responsible environmental behaviors.

- Arch Property Risk Control service platform provides environmentally focused support and training to our insureds.

Enabling Health, Safety and Optimal Outcomes for Our Customers

Our Casualty Risk Control service platform offers health and safety support and best practice recommendations for our insureds. This support includes:

- Consulting on Work Site Safety, Employee Onboarding and Post-Injury Management Programs: Helping customers develop and implement consistent workplace safety orientation and training programs, and assisting our insureds in developing policies and systems to hold their supervisors accountable for these critical activities.

- Consulting to Protect the Public: Assisting clients in developing plans and implementing best practices to eliminate or minimize exposure to common hazards, including driving hazards, highway work zone accidents and slip/fall exposures in retail environments.

- Safe Driving: Helping customers properly screen and manage employee drivers of all types of vehicles to improve their on-the-road safety performance. For example, combating distracted driving, reinforcing defensive driving skills and providing access to continuous employee driver record monitoring so our customers can better assess their drivers’ risk profiles.

Access to Finance and Social Equity Products

We are dedicated to ensuring a sustainable future for our insureds by offering a range of products and customer-oriented solutions that help build safer, stronger and more inclusive communities.

- Through our mortgage insurance (MI) products, we enable families to purchase homes and accumulate wealth. In 2024, 139,000 families in the U.S. attained homeownership with Arch MI, approximately 29% of whom were low-income buyers.1

- Our lease rental bond program issues surety bonds to offer rent payment security for apartment leases throughout the U.S. Since its launch, the program has aided nearly 100,000 individuals or families achieve their housing goals.

- Our subsidiary, McNeil & Company, Inc., insures firefighters and emergency responders primarily through our leading ambulance and emergency services insurance programs. We also offer a risk management webinar series to help enhance the skills, safety and overall effectiveness of these first responders. We offer approximately 600 courses on an E-learning platform with over 125,000 users from over 5,400 organizations.

- Our team supports key clients by underwriting programs that enable financing for governments in developing countries and emerging economies. We insure lenders against sovereign default risks, collaborating with top-tier multilateral organizations to back projects that drive economic and social growth. Arch’s agriculture team facilitates micro-insurance schemes in developing countries, enabling banks and financial institutions to extend loans to smallholder farmers without requiring personal land as collateral.

1 Loans where the qualifying income was less than 80% of the area median income in their census tract; includes both purchase and refinance. See Bank Rate survey.

Three Lines of Defense

Risk management responsibilities are delegated across our organization through a “Three Lines of Defense” approach to risk governance. This risk management framework, reinforced by key controls and activities, is embedded within our operations and enables us to limit risk and evaluate opportunities. We view sustainability risks as enterprise-wide risks.

Three Lines of Defense

Download the chart above as a PDF.