Our Investments

We believe integrating sustainability factors into investment analysis may contribute to improved returns, reduces risk over the long term and aligns with our stakeholders’ best interests. We recognize the importance, relevance and significance of assessing sustainability topics in the performance of the entities in which we invest.

Responsible Investing

Our Responsible Investing (RI) Policy, adopted in early 2022, provides a framework for governance, investment strategy, engagement, reporting and communications. In developing the RI Policy, we considered the six principles set forth by the United Nations Principles of Responsible Investment (UN PRI). The RI Policy reflects our approach to sustainable value creation by considering sustainability factors, including climate change, in the investment process for all asset classes under our management.

Making Responsible Investments

As of Dec. 31, 2024, we had $223 million invested in green bonds issued to fund green projects, activities that promote climate change mitigation or adaptation, or other environmental sustainability purposes. Our green bond investments decreased 1.5% year-over-year.

As shown, our approach to responsible investing remains fairly stable year-over-year, with a 1% decrease, as a percentage of assets under management (AUM) since 2023.

Assets with UN PRI

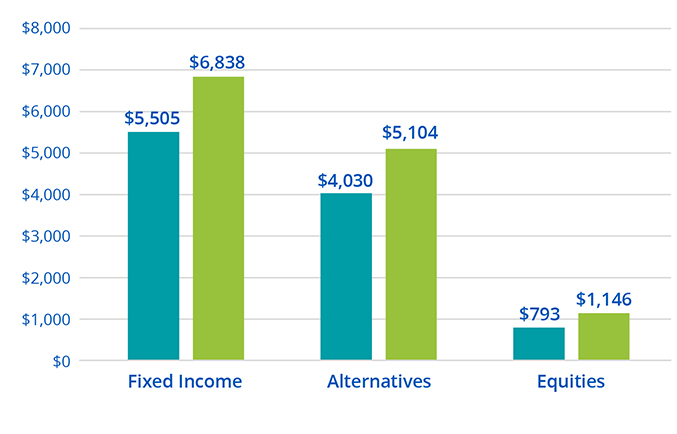

We recognize the commitment that becoming a UN PRI signatory requires and highlight our asset owners or asset managers that have achieved this distinction. Our assets managed by UN PRI signatories improved year-over-year (i.e., 2023 and 2024) representing 32% of the total AUM and 85% of the total externally managed assets, approximately $13.1 billion as of Dec. 31, 2024.